October 03, 2023

Unlocking the Power of Blended Finance for Social Enterprises

By D&A Team

An analysis of the role of blended finance in addressing the financing challenges faced by social enterprises in India, offering insights, case studies, and recommendations for leveraging these solutions.

Written by Mehak Bhargava (Sr. Associate) & Jonathan John (Sr. Associate)

Villgro Innovations Foundation and Desai & Associates are proud to announce the launch of, "A Practitioner's Guide to Effective Blended Finance Solutions for Social Enterprises”, a comprehensive report documenting the challenges and opportunities in scaling blended finance solutions for social enterprises. Supported by the Lemelson Foundation, the white paper discusses the key recommendations and insights from the investors, philanthropies, social enterprises, and ecosystem players in scaling blended finance solutions to unlock capital for social enterprises and drive inclusive impact in India.

Why Social Enterprises?

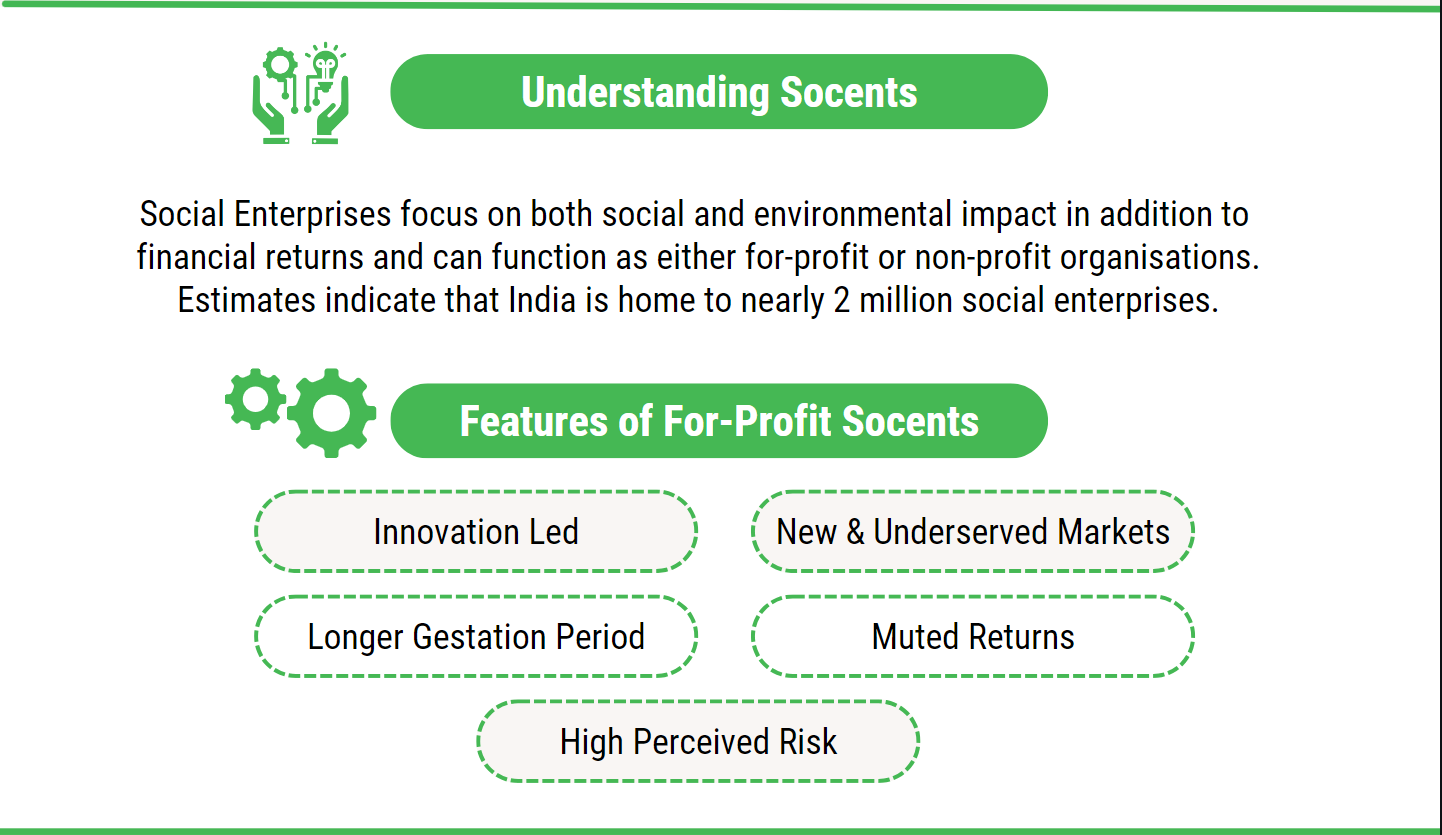

India has a thriving landscape of social enterprises that are solving India’s key developmental challenges and driving social inclusion. These ventures tackle pressing global challenges like climate change, financial inclusion, access to quality education and healthcare services offering innovative solutions and driving change where traditional models fall short.

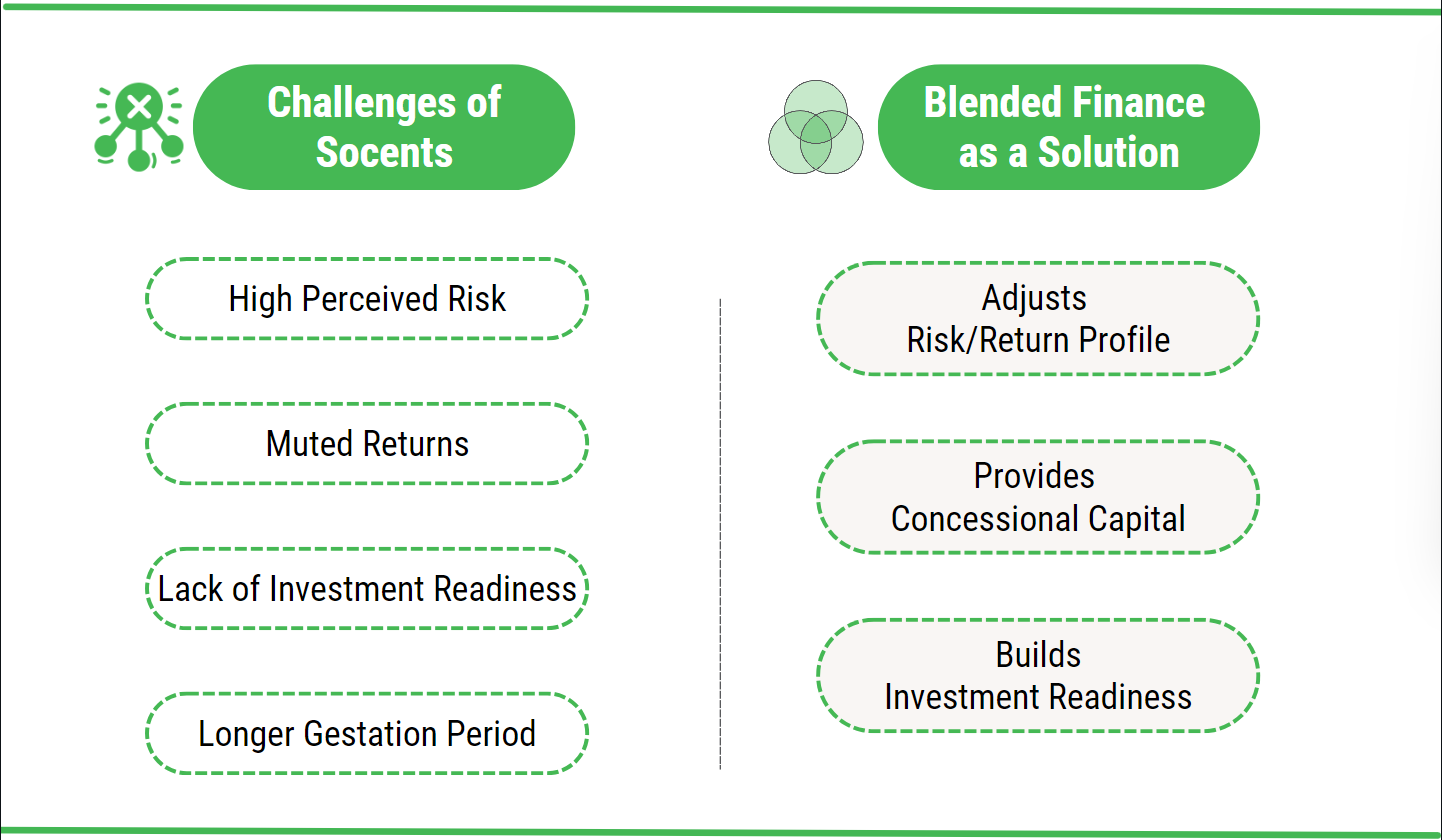

However, social enterprises struggle to access finance given their unique business models, low or market financial returns, longer adoption cycles, and time to profitability. These characteristics make them unattractive investments for equity and debt investors, while philanthropic capital is limited and looks for more impact instead of these market-based models resulting in a financing gap for social enterprises.

Opportunity for Blended Finance to Bridge the Financing Gap

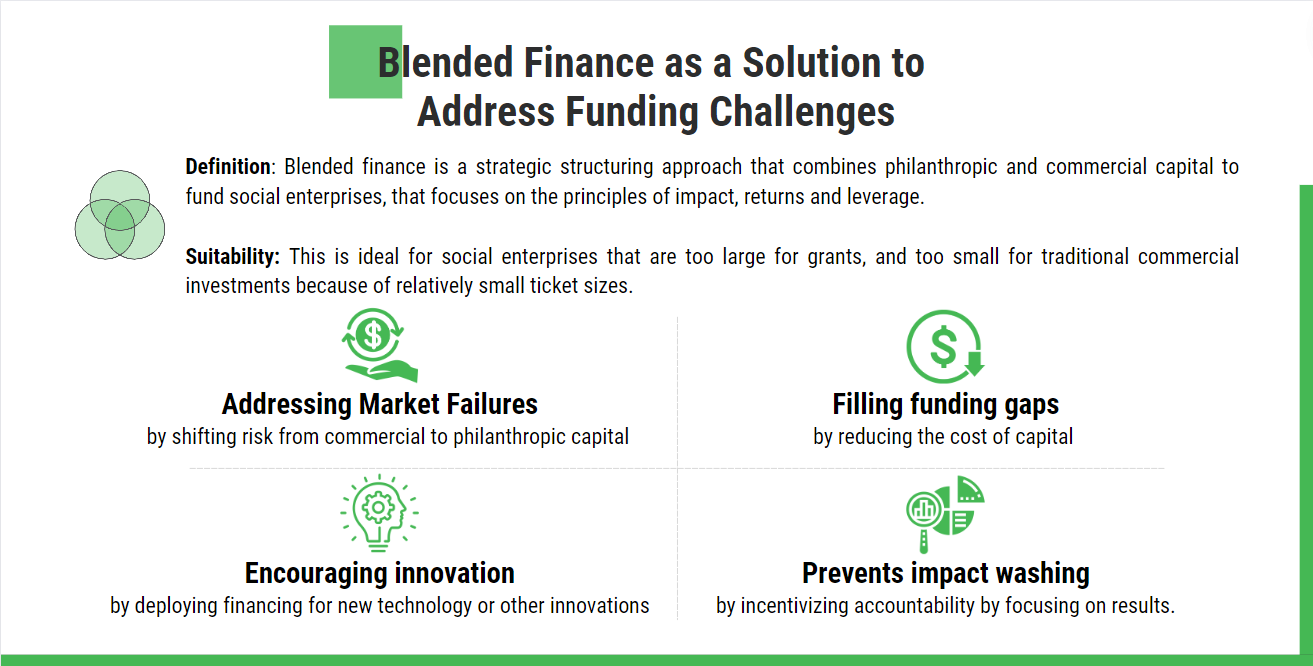

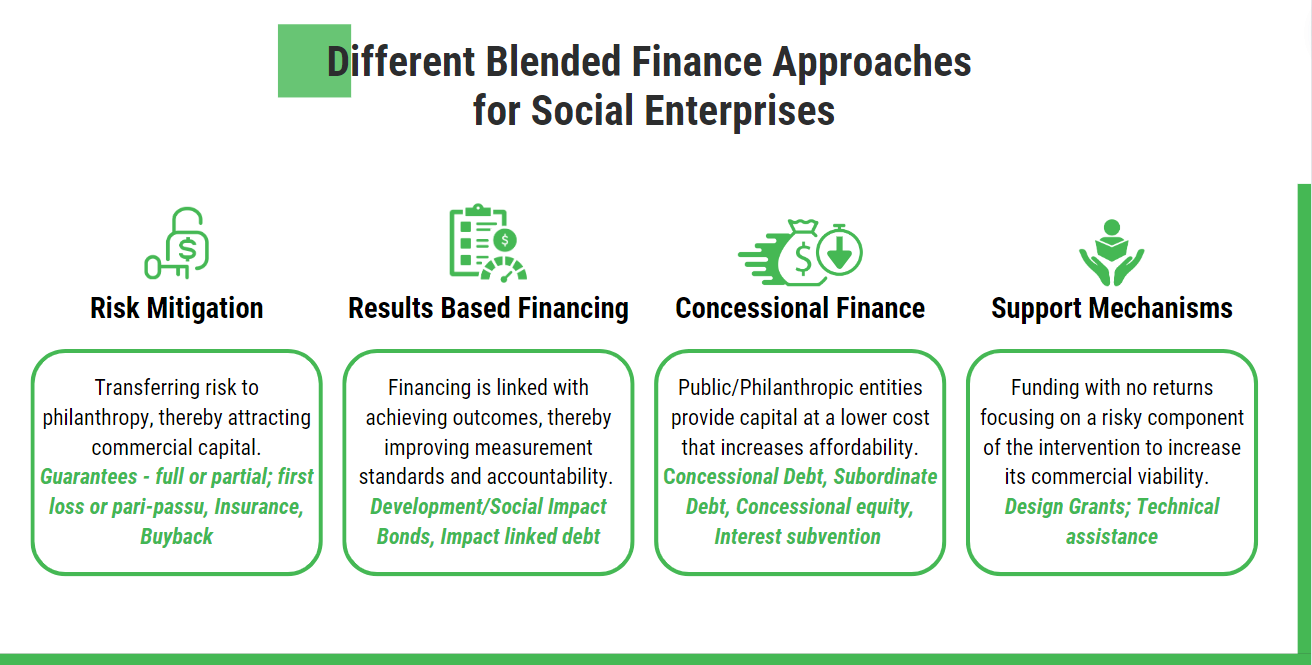

Blended finance solutions offer the potential to combine development capital with a variety of financial instruments such as impact bonds, concessional capital, and risk mitigation structures. These solutions can overcome the financing gap faced by social enterprises by adjusting the risk-return profile, providing concessional capital, and building investment readiness through technical assistance.

What Does the Guide Offer?

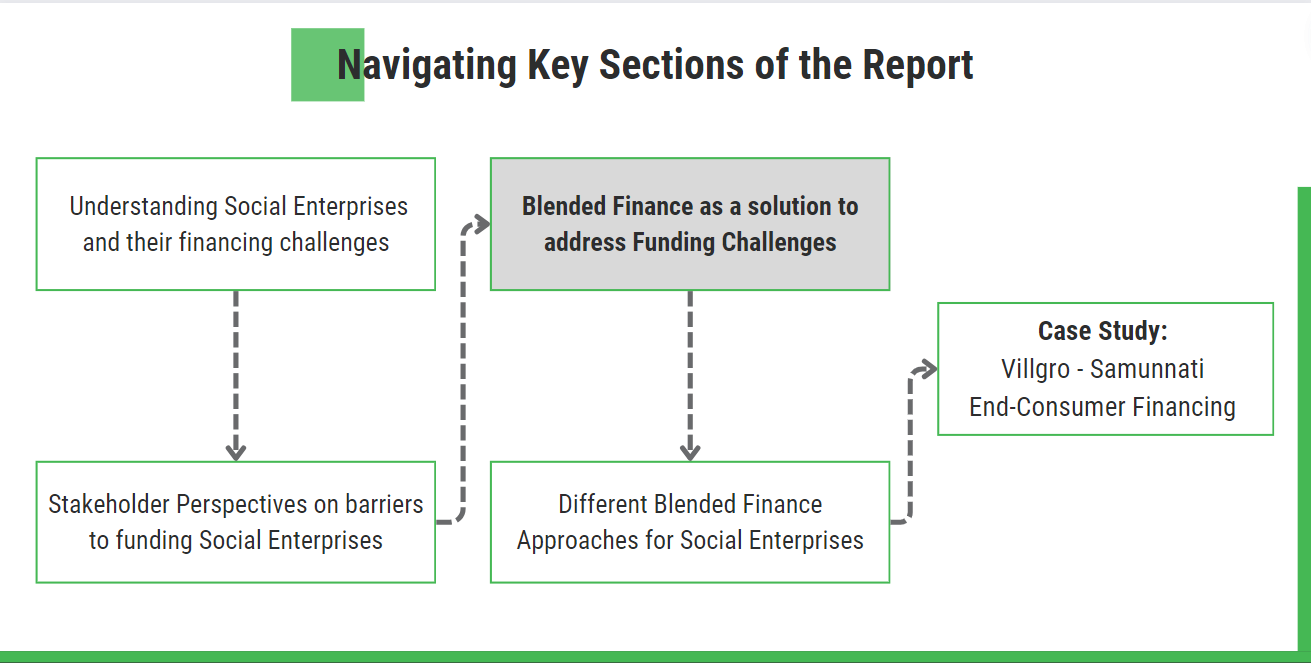

The report maps the challenges and recommendations from investors, social entrepreneurs, philanthropies, and ecosystem players in scaling blended finance solutions. Here are some of the key takeaways:

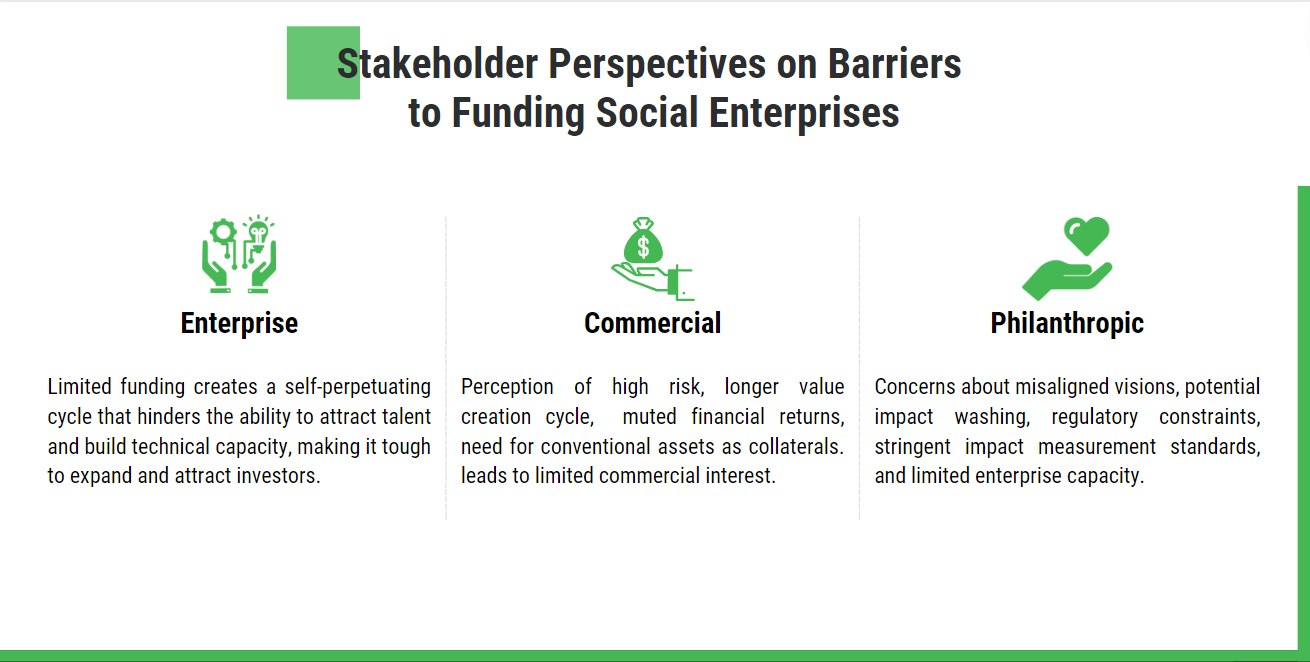

Institutional Perspectives on Blended Finance: The report captures the institutional roles and barriers faced by investors, banks, NBFCs, philanthropies and ecosystem players in adopting blended finance solutions.

- Social Enterprises - Limited capacity and funding that restricts them from absorbing blended finance solutions.

- Commercial Investors - Banks, NBFCs and investors consider social enterprises as high risk investments, often primarily due to lack of collateral or muted financial returns and require large scale transactions to justify the high fixed costs associated with capital disbursement.

- Philanthropies - Prefer strong impact additionality and attribution, and struggle with regulatory constraints, impact washing, impact measurement challenges, misaligned visions and limited enterprise capacity.

Blended Finance Solutions: Various blended finance approaches and instruments are applicable to social enterprises based on their investment stage, sector dynamics, and other financial parameters. Identifying the appropriate instruments is crucial to ensure effective capital allocation and utilisation.

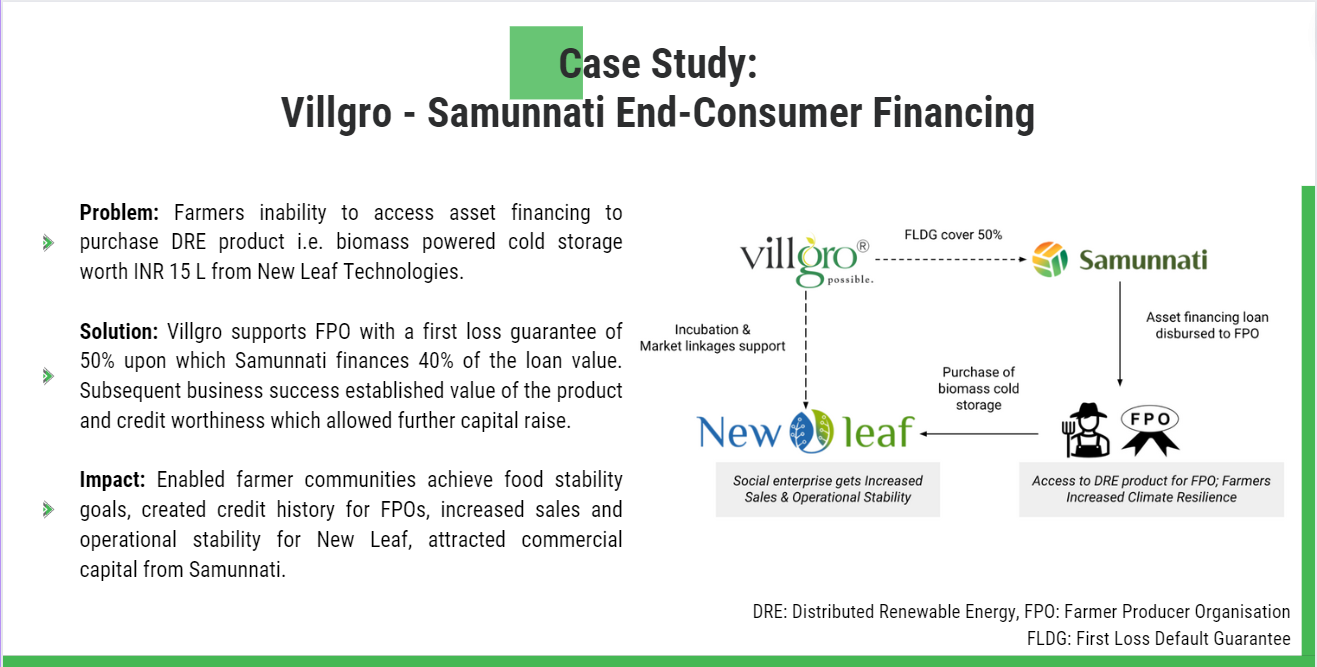

Case Studies: The guide captures several success stories on blended finance solutions for social enterprises. Given below is a snap shot of a success story featured in the guide, highlighting the ability of blended finance to achieve financial sustainability for social enterprises while driving social impact.

Case Studies: The guide captures several success stories on blended finance solutions for social enterprises. Given below is a snap shot of a success story featured in the guide, highlighting the ability of blended finance to achieve financial sustainability for social enterprises while driving social impact.

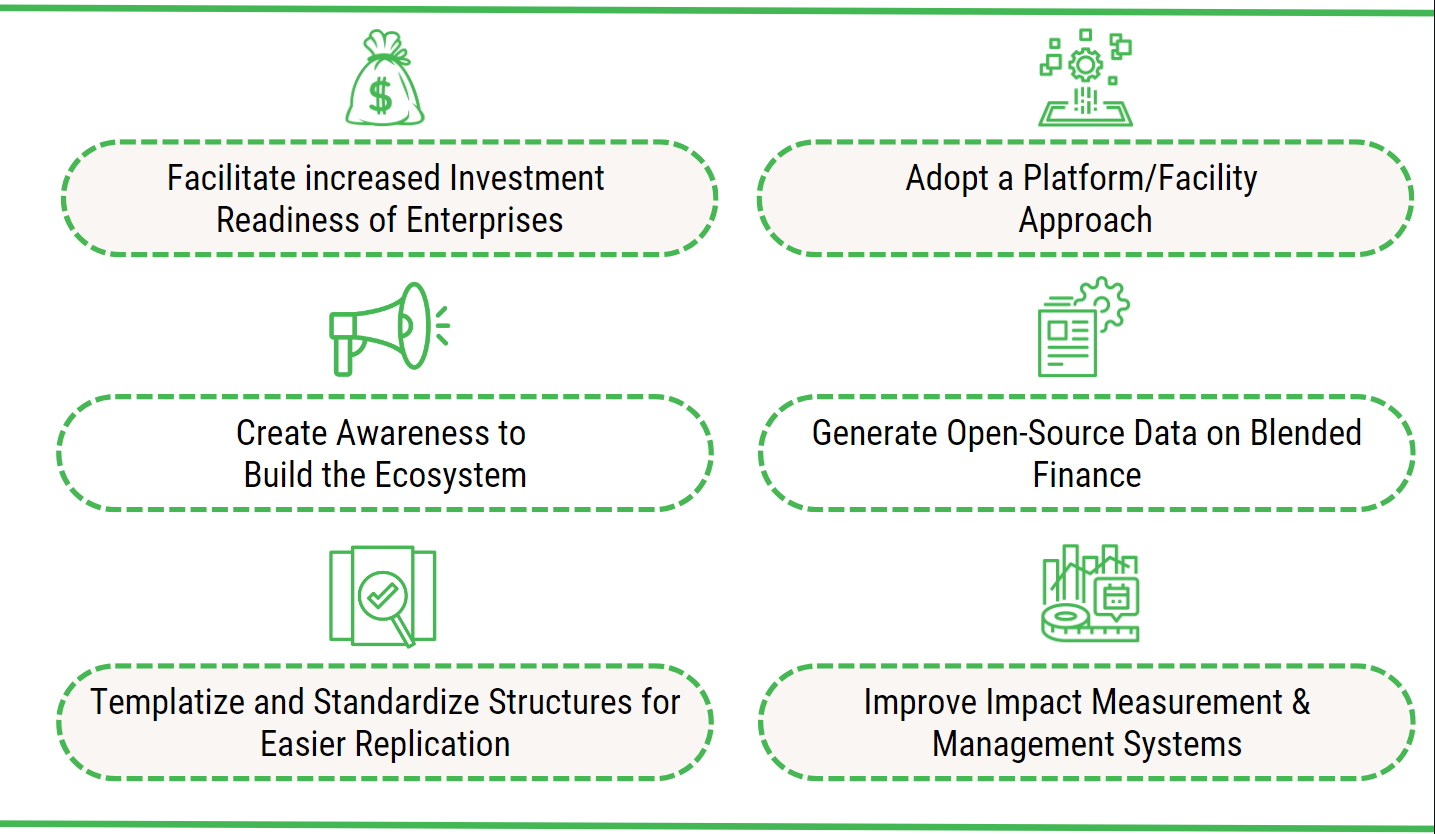

Recommendations: The guide captures valuable insights on key recommendations and actionable practices given by stakeholders such as -

- Improve investment readiness of social enterprises through blended finance to absorb commercial financing solutions

- Create awareness about blended finance and standardisation its solutions for wider adoption and deployment

- Incorporate long term sustainability into the design of the blended finance instrument to reduce reliance on philanthropic and concessional capital.

This guide hopes to empower investors, philanthropists, social entrepreneurs and policy makers in adopting blended finance solutions to bridge the financing gap faced social enterprises and forge new paths towards a more equitable and sustainable future.